Infrastructure for Request to Pay

PAYCY for financial institutions

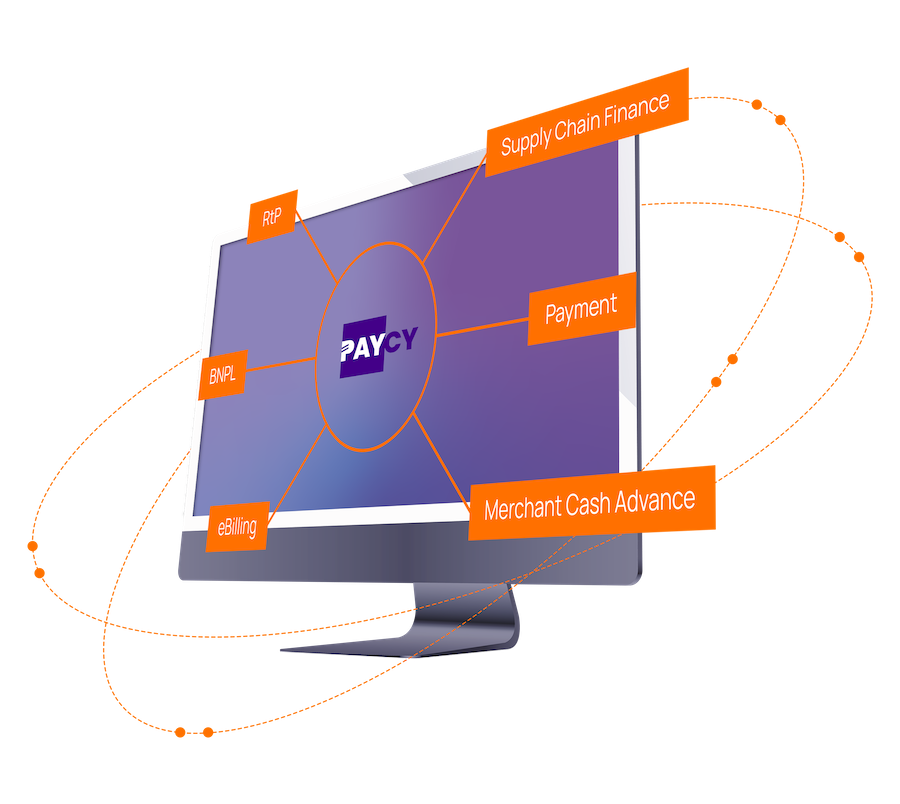

Added value

Customer loyalty

Account

Liquidity

Neutrality

Independence

Questions & Answers about PAYCY?

A creditor's financial institution forwards a Request to Pay for one of its own customers to the PAYCY platform. From there, the Request to Pay with the invoice data is sent to the debtor's financial institution. If the debtor authorises the Request to Pay, the money flows. As Request to Pay is an EU-wide payment scheme, the platform also includes cross-border payments within Europe.

PAYCY stores a unique identifier to deliver a Request to Pay across financial institutions as well as the invoice data. This data can in turn be integrated into the front end of online banking, into the banking app or other software that financial institutions provide for their customers. The latter are thus provided with a digital archive.

No. Neither PAYCY nor the connected financial institutions find out what exactly a customer buys and which items are listed on an invoice. Similar to credit transfers, only the information necessary for a transaction can be read out when a Request to Pay is created or delivered via the platform.

PAYCY enables the conversion of invoice data, for example, from the German format ZUGFeRD to the French format Factur-X, and the provision of invoice data in an electronic archive. Further additional services can be realised individually or by the connected financial institutions themselves in their own IT systems.

No. PAYCY is not a payment initiation service within the meaning of the PSD2. The platform accepts a Request to Pay and delivers it to the receiving financial institution to authorise the requested payment. The payment itself is initiated by the customer and processed via the financial institution's existing payments infrastructure.

The European Union promotes e-billing and already provides its own standard (link). In addition, more and more EU countries are introducing electronic invoices on a mandatory basis. Germany is likely to follow soon as the project is listed in the coalition agreement (p. 132). Moreover, PAYCY increases convenience for customers who frequently need to reconcile payments and invoices (reconciliation). This applies to both the payer and the recipient side. Furthermore, accounting processes can be better automated if all information is stored in a central place – at the account.

PAYCY only accepts orders that contain a Request to Pay or are to be converted into one from invoice data. The ISO 20022 standard provides a dedicated order type for this (pain.013). If financial institutions receive an order of this type, they can route the Request to Pay to PAYCY and have it delivered.

This depends on how the bank evaluates the service. According to MaRisk, this is at the bank's own discretion. If a bank classifies PAYCY as outsourcing, all regulatory requirements for outsourcing on the part of PAYCY are fulfilled. These include, for example, the guidelines of the Euro Banking Association (EBA) on outsourcing and MaRisk.

PAYCY follows the plug-and-pay principle. Financial institutions connect to the platform via APIs or EBICS. From that point on, they can be reached by all other connected institutions to receive and send a Request to Pay. PAYCY banks are fully Request-to-Pay-ready as soon as they have connected.

PAYCY solves the sender-recipient problem for all financial institutions connected to the platform. Non-connected financial institutions face a 1:n problem because they have to connect each financial institution individually to deliver or receive a Request to Pay. With PAYCY, there is only one partner that the financial institutions have to integrate.